How Can You Retire Early at age 40 or 50 Years Old

(Part 2 in a series that will cover investing terminology, workplace retirement accounts, starting a brokerage account, handling taxes and how to withdraw your dividends to live. Read Part 1. Join The Wealthy AchieveHer Financial Freedom Program where we work through your money concerns together. This blog is not financial advice. Do your own research and consult your own professionals. )

What is FIRE?

Financial Independence, Retire Early is the concept of changing your goals in life to be financial-free versus being a consumer. Traditional thinking goes like this:

1. Go to college

2. Get a “good job”

3. Have a pension plan Put 5-10% in your 401k including any match

4. Get married and have a big wedding

5. Buy a big house

6. Buy nice cars

7. Have kids

8. Travel

9. Buy yourself nice things because you worked hard, and you deserve it

10. Hate your job

11. Retired at 67 years old

12. Enjoy old age

13. Wish you would have retired sooner

Our economy wants you to work until 65 or so because they need workers and consumers. What if you could shift out of being a worker and start living more? How can you move up retirement so you can enjoy more of your time with friends and family but still live a good life enjoying travel and living where you love? Learn more from this blog How to Become Financially Independent.

FIRE Mindset is Spending Less and Investing More.

Here are two things you need to do to get FIRE:

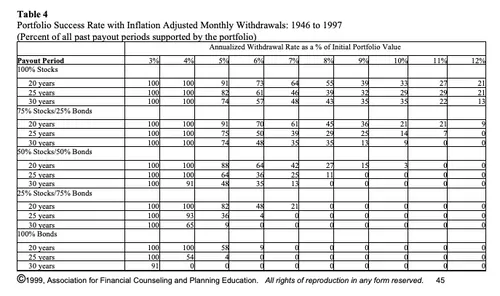

1. Build a Nest Egg to Live Off. When you save 25 times your living expenses, (click to read this called the “Trinity” study) you can live off that nest egg successfully for at least the next 30 years depending on your allocation. Specifically, 75 stock / 25 bond allocation. More often than not, you will die with more money in the nest egg than you started with even after withdrawing each year.

2. Live off 4% of your Nest Egg (give or tax percent or two) per the study quoted above. I’ll explain how to get that money out later.

Mind blown! Examine the chart below from the study:

How do I Build That Nest Egg?

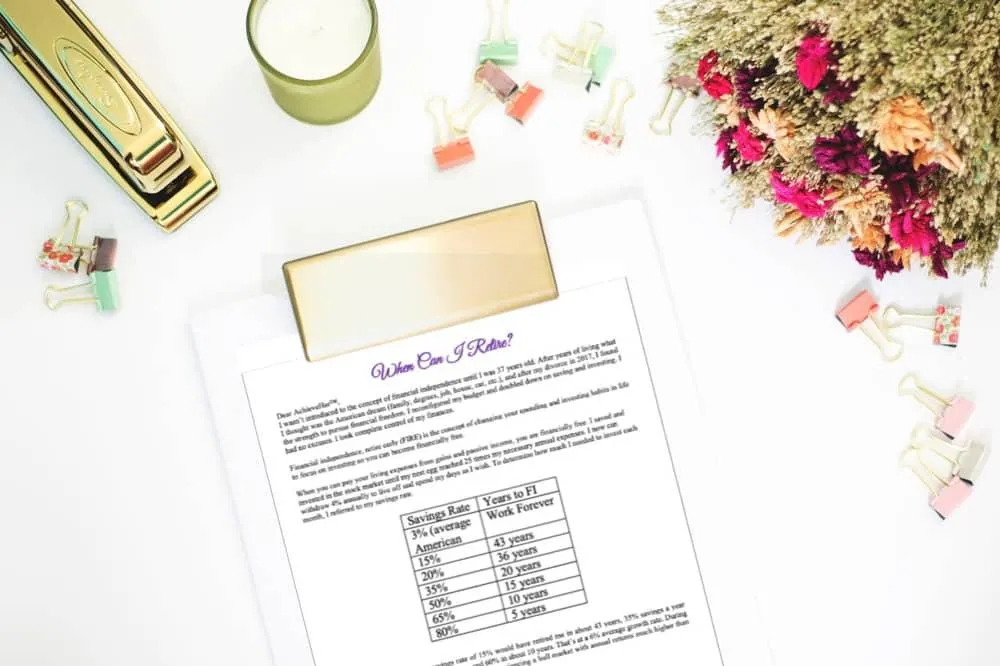

Focus on your savings percentage rate. The more you save the faster you’ll build your nest egg. In 2012, Mr. Money Mustache revealed the shockingly simple math behind early retirement. The time to reach financial independence is purely dependent on your savings rate. Your savings rate is the percentage of your GROSS income you save and invest each year.

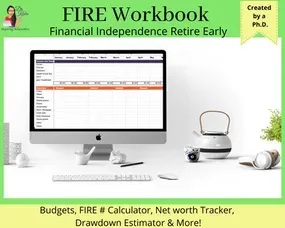

We’ve been told to save 10% of your income. If you do that you will need to save for 40+ years to live off your nest egg. How much are you currently saving? If you don’t know, you need to grab my FIRE Excel Workbook and start calculating your expenses and savings rate. The workbook comes with an explainer video of me walking you through all of the information.

Accumulate a nest egg of stocks (about 70% of portfolio) and bonds (about 30% of portfolio) where you can live off the appreciation (4%) of that nest egg amount each year. Depending on your savings rate and how much risk you are willing to take, you will reach your number faster or slower. It’s not hard, it just takes time. How much time? Remember, it depends on how much you invest each year.

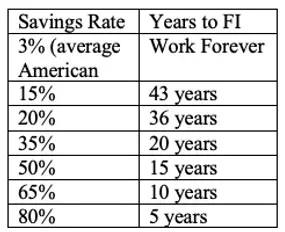

Let’s say you are starting at 0 net worth and will start investing with earnings around 6% a year. According to Business Insider and many other writers on FIRE here’s how long it will roughly take you to build your nest egg to retire:

Five, ten, and 15 years go by really fast. If you are 30 you can easily be financially free by 45 years old if you live on half your income. It has been done. But do you see how increasing a percent leads to earlier retirement? You can start at any age but the first few years are the hardest and longest, the first 100k takes the longest but then you will be working with exponential growth.

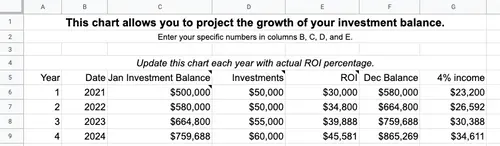

Put another way, you can estimate your contributions and investment growth in a spreadsheet like this one in the FIRE workbook. The calculations have already been entered for you. Get it today.

But it’s impossible to save half my income, right?

You won’t get there overnight. Start by doubling what you currently contribute. You just have to think about what you value. Do you value expensive bags, shoes, and clothes over saving half your income so you can be wealthy? How much do you value things that won’t pay you 6% annual dividends? I am not trying to throw shade. I’m just trying to get you to think about these things long-term. Today, you might enjoy your “job”. But within 5 years you may hate it and need a break. But if you can’t produce income from investments or real estate or something, you will have to go to work. There are things you can do to start to reduce your expenses and invest more. For example, I switched from Verizon to Mint Mobile. My iPhone X is paid off and I wasn’t on any contract. Mint Mobile is a flat $15 a month (3GB Plan, I average about 2GB) and it runs on the T-Mobile network. I have noticed no difference in service from Verizon. I love it! You can try it out before cutting off your current service. That’s what I did. Check it out.

How much of a nest egg do I specifically need to be Financially Independent?

It’s this simple: Take the living expenses that you plan to have when you stop working and multiply the amount by 25. Living expenses are housing, healthcare, childcare, food, bills, travel, and reasonable spending, etc. Don't struggle with the math. I've created the calculations for you in the FIRE workbook. This automated spreadsheet is one of several in a workbook to help you plan out your FIRE plans. Get it on my Esty shop!

This calculator is in my FIRE Workbook. Check it out.

Side note: Social security is such a small factor that I don’t usually include it in my calculations. If anything, I look at it like getting a Christmas bonus.

How do I allocate the contributions and what do I invest in?

I start with my workplace retirement accounts because of the tax savings. Personally, I buy growth mutual funds and bonds with low expense ratios. Bonds should be held in retirement accounts versus brokerage accounts because pretax retirement accounts shelter taxes. Meaning, the dividends from bonds will not create a taxable event for you this year as they would if you held bonds in your brokerage. I max out my pre-tax retirement accounts each month first because this lowers my taxes right now.

Entrepreneurs! You have not been forgotten! You have a sweet deal if you are an LLC or Limited Partnership. You can contribute to a Self-Employed 401k or a Solo 401k and contribute up to $56,000 per year. This money is protected from taxes!

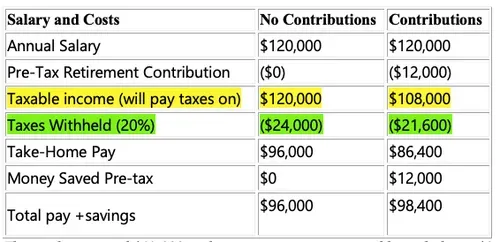

Here is an example of the paycheck tax savings:

The employee saved $12,000 in their retirement account and brought home $2,400 more than if he or she didn’t save at all. Boom! I use TaxCaster (free) by Turbo Tax to estimate my refund.

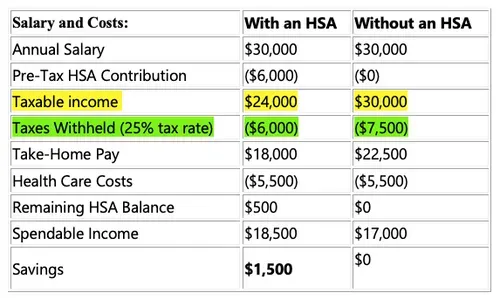

1. HSA accounts: If it’s right for your situation and you choose a high deductible healthcare plan, you will have a healthcare savings account (HSA) tied to it.

a. The HSA is a wonderful way to save more money pretax! If you end up having healthcare expenses you simply pay from them out of your HSA. Look at the chart below and notice the tax savings:

b. Here is an even better benefit that often isn’t spoken about. You can delay taxing an HSA distribution for medical expenses. The great benefit of having an HSA is that I can decide when to pay myself back. Since there is no rule stating that you must use your HSA to directly pay for medical expenses or that you must withdraw money from your HSA within a certain amount of time after paying for a medical expense, you can take out the money when you want. As long as the qualified medical expense occurred after the HSA was opened, you can withdraw money from the HSA at any time after incurring the expense to reimburse yourself. Since I am already maxing out my other tax-advantaged accounts and have ample savings, a $250 doctor bill payment isn’t going to break the bank so there is no rush to get paid back from my HSA. Instead, I can leave that $250 in my HSA and can sit back and watch it grow, tax-free, until I decide to withdraw it.

I need to keep my receipts (and make digital copies, in case the physical copies wear out) so I can withdraw the money for qualified medical expenses from my HSA at any time. If you don’t use your HSA funds for medical expenses, you can begin withdrawing money from your HSA account for any expenses after you turn 65, without penalty. You’ll have to pay income tax on any distributions that aren’t for qualified medical expenses, just like you would with a Traditional IRA, but you won’t incur any additional penalties or fees. Therefore, after the age of 65, an HSA is nearly identical to a Traditional IRA but it’s still better because your withdrawals for medical expenses are still completely tax-free!

2. Next, I max out my Roth IRA. This is funded with after-tax money. Once you receive your paycheck you can send money to a Roth IRA. You will not save any income taxes at the time of the contribution. You can always take out your contributions tax and penalty-free any time. There is also such thing as a Roth 401(k) at some workplaces. You may or may not be able to contribute to this if you are maxing out your pre-tax retirement account. Get your own professional advice.

3. Lastly, I put funds into my brokerage account at Vanguard. I purchase stock market index funds. Index funds are comprised of many stocks. I try to stay away from individual stocks because it’s difficult to stay diversified. It’s riskier to me to hold individual companies versus a fund of many companies. You may be fine with the risk and that is okay. You should always do what’s best for your situation. For me and my house, we focus on the S&P 500 index mutual fund called VTSAX (about $95 a share at the time I wrote this) or index ETF called VOO (about $195 a share at the time I wrote this). Learn more about it at Vanguard. This is what I do and I am not saying it is what you should do because you are reading this. Contact me with questions.

4. Entrepreneurs can start retirement plans as discussed in Part 1 of this series. They can also jump straight into a brokerage account and start investing in index funds.

Whew, that was a lot!

Homework:

1. Enroll in the Financial Freedom Course.

2. Calculate your current savings-investment rate. Can you reduce some spending or expenses to invest more and max out preretirement accounts?

3. Come up with three financial goals for this year and next.

4. Write up your 5 estate planning documents.

5. Download Personal Capital net worth tracker. It's an app that allows you to see all your money accounts in one place, in real-time. Get your Retirement Readiness Score™ in minutes, Use Fee Analyzer™ to find hidden fees in your retirement accounts. Sign up and we both get $20.

The F.I.R.E. Workbook that I created has everything you need to pay off debt and build wealth with over 8 worksheets and a full 30-minute explainer video.

I am thankful you are here to learn and hope you find value here. I am not a financial advisor. I am sharing how I became financially independent in hopes that the information is useful to you in your research journey. Also, consult your tax accountant and do your own follow-up research :) If you purchase on my Amazon Store links or other affiliate links, you are supporting me and this free information with no additional cost to you. Thank you!