Estate Planning:

Explaining the 5 Must-have Documents before you Die

1. Healthcare Directive

What it is: A legal document that appoints an agent to handle HEALTHCARE related decisions on your behalf if you can not do so. It also details how you want to be cared for when you are seriously ill or are in a terminal state.

Why you need it: If you get too sick to communicate, would someone close to you to be able to express your wishes for care? For example, if someone is badly injured in a car accident, the hospital may need to know what the person considers an acceptable quality of life. Does the person want CPR, life support, tube feeding, etc. What about hospice care? Organ donation?

Where to find it: Google search "health directive template (your state name)" to find examples for your state. You can also find common estate planning documents in books and easy to walk through software like Nolo. Templates through the state can be downloaded at no charge to you but you'll need to know what you are doing. It wasn't very difficult. Here is a set of advanced health directives and will templates with detailed instructions that are very helpful.

How to make it official: You and a witness(es) will need to sign this document in the presence of a Notary Public. Then, give a copy to your primary care doctor, the person who can make the health decisions for you when you are unable to do so, and keep one in your personal files.

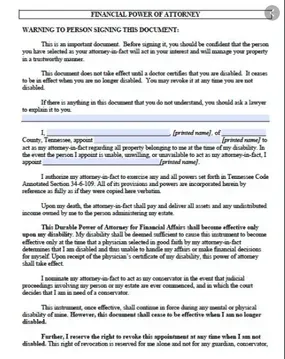

2. Financial Power of Attorney

What it is: A legal document that appoints an agent to handle FINANCIAL matters on your behalf if you can not do so. It only goes into effect once a doctor certifies that you are disabled. But make sure you appoint someone you trust because they will be able to access your accounts and spend it!

Why you need it: If you are disabled and can't balance a check book, you will need someone to handle your financial affairs. For example, pay your bills, pay for medications, etc.

Where to find it: Google search "financial power of attorney template (your state name)" to find examples for your state. You can also find templates on common estate planning websites like Nolo, but you may have to pay them for those documents. Templates through the state can be downloaded at no charge to you.

How to make it official: You and a witness(es) will need to sign this document in the presence of a Notary Public. Then, give a copy to your primary care doctor, the person who can make the health decisions for you when you are unable to do so, and keep one in your personal files.

3. Last Will and Testament

What it is: A legal document that describes your final wishes in regard to individual property, who will carry out your wishes AFTER YOUR DEATH. It also nominates a guardian for any surviving children. A will is the place to name the guardian, not the trust. All wills must be validated through the court process of probate.

Why you need it: When one dies, the will can be the source to describe who gets what and how you wish to be buried or cremated. Having a document helps your loved ones tremendously. I am planning to have my ashes spread in the ocean in Jamaica!

Where to find it: Google search "last will and testament template (your state name)" to find examples for your state. You can also find templates on common estate planning websites like Nolo, but you may have to pay them for those documents. There are many free last will and testament templates on the Internet.

How to make it official: You and a witness(es) will need to sign this document in the presence of a Notary Public. Then, give a copy to your grantor (named in your will), attorney, and keep one in your personal files.

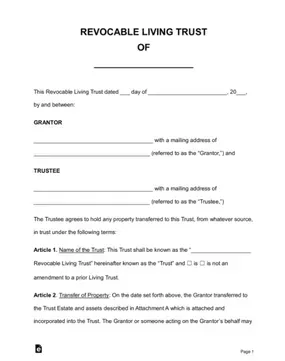

4. Trust

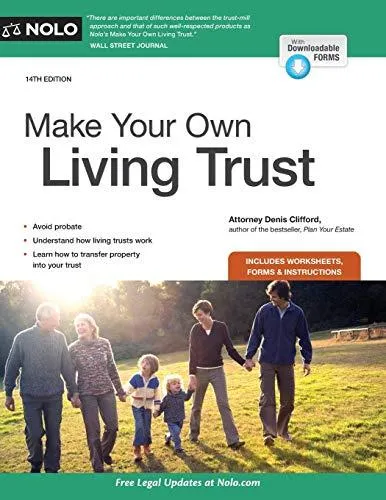

What it is: There are two popular types of trusts. Revocable trusts have assets that you (grantor) control and can change at any time, and irrevocable where the terms can not be modified without the permission of the grantor's beneficiaries. A trust is a legal document that manages, distributes and holds title to property in the PRESENT and FUTURE. A successor trustee manages the trust upon the incapacity or death of you, the trustee. Trusts are private and the family is in control of it, not the courts or the state. I used this free one from eForms and paid an attorney review it and provide feedback. Pick up this book, Making Your Own Living Trust and get it done yourself:

Why you need it: You likely need both a will and trust for a comprehensive estate plan. A trust is made to bypass probate court, meaning, your assets pass directly to who you name in the trust because the trust owns the assets (fund your trust below). It's also private so you don't have to publicly disclose what you control because it's in the name of the trust. In the appendix, you will list out all property and assets you want controlled by the trust. You will be surprised by how long your list is!

Where to find it: Google search "revocable trust template (your state name)" to find examples for your state. You can also find templates on common estate planning websites like Nolo, but you may have to pay them for those documents. You may find that a step by step online software system is more convenient that creating it on your own. Of course, consult an attorney to determine specifics about your situation.

How to make it official: You and a witness(es) will need to sign this document in the presence of a Notary Public. Next you will need to fund your trust. Fund the trust by renaming assets in the name of the trust. Your automobiles, home and some non-retirement accounts can be renamed to the trust. Then, give a copy to your Successor Trustees and keep one in your "when I die" personal files.

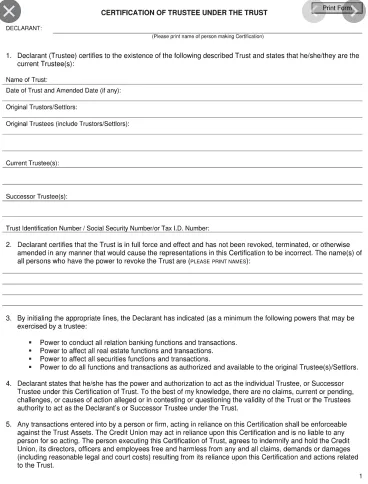

5. Certificate of Trust

What it is: A short summary of your trust that certifies that you do in fact have a trust. The certificate states the name of the trust, date it was created, grantor, trustee, successor and power of those roles.

Why you need it: Since your trust is private, you don't have to publicly disclose what is in it. But when you go to rename assets in the name of the trust, the institution will want proof that a trust exists. You give them the certificate of trust as proof.

Where to find it: Google search "certificate of trust template (your state name)" to find examples for your state. You can also find templates on common estate planning websites like Nolo, but you may have to pay them for those documents. You may find that a step by step online software system is more convenient that creating it on your own. Of course, consult an attorney to determine specifics about your situation.

How to make it official: You and a witness(es) will need to sign this document in the presence of a Notary Public. Next you will need to fund your trust. Fund the trust by renaming assets in the name of the trust. The trust can hold your automobiles, home and some non-retirement accounts. Remember, if you create a revocable, you still control those assets because you are the grantor and trustee. Give a copy to your Successor Trustees and keep one in your "when I die" personal files.

Time Investment

I spent about a full week creating the five documents. I then hired an attorney (in my network) to review the documents. We had two meetings, about an hour each, going over specific changes that needed to be made. Then, we met up, with witnesses, to sign and notarize the documents. I wasn't quite finished yet. It took another few days to get most of my accounts transferred to the Revocable Trust. Make sure you document all of your passwords and give them to someone you trust!

Whew! That was a lot to share but I hope it was a good overview to get you started. I am glad I put together my documents because it forced me to think about every single thing I own and what I want to happen to it while I am alive and once I pass on. But I am not an attorney and am not giving advice. it's important to speak with an attorney about your specific situation.

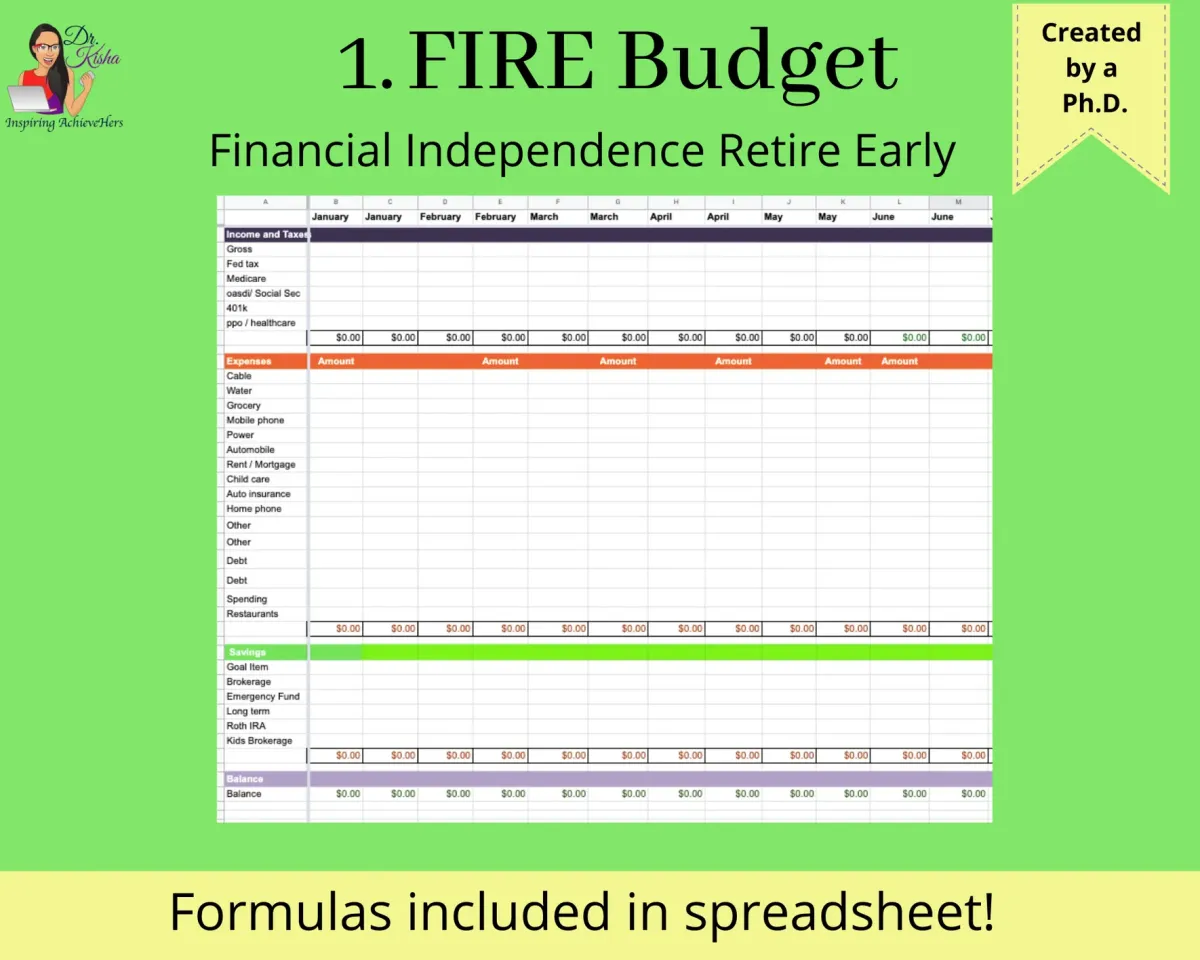

I hope this was helpful! While you are estate planning, make sure you are using an effective budgeting tool. Again, I like to be knowledgeable about every facet of my affairs so I use Microsoft Excel for most of my budgeting tools. Check out the Microsoft Excel budget that I use to plan my spending and investing. It's one worksheet for the whole year, divided out by month. I'm making it available in hopes that it helps other effectively control their finances. If you find it useful, I would appreciate your business!