This Budget Bestie is ChatGPT friendly & Helps you Saves up to $300 a month!

I’ve heard you loud and clear. You have a hard time budgeting your money and tracking your day to day spending. Without a clear budget you can stick to, you are having a hard time getting to a point where you can save, pay off debt and invest for your financial freedom or comfortable retirement. You can't even think about investing for financial independence retire early (FIRE) when you feel like you have no financial peace and are all over the place with your money.

Look no further! This budget planner will give you the financial peace you are looking for to create your rich life full of happiness!

Read on for money-saving budget tips!

Reflecting on your life and relationship with money

How is your relationship with money?

Have you ever been embarrassed about your financial situation? I know I have. I grew up in Indiana. I didn't live with my parents most of my life growing up. I bounced around and lived with several different family members and even family friends throughout my childhood. When I started working at 14, I learned quickly to hold on to whatever little money I had.

At 15, I opened my first checking account (under my uncle's account) and learned how to use a check register to manage my paychecks from McDonald's, where I worked at the time.

I'm thankful for my childhood because I learned how hard it is to earn a dollar and just how easy it is to spend it. I always think about my early experiences around money and how they've shaped my frugal nature. I'm a firm believer that I must be open and honest about where I come from and where I am currently financially so that I can take the appropriate actions to set myself up for a better financial future.

Budget Categories in Budget Bestie

In my opinion, the purpose of a budget is to spend as little as necessary on most expenses to have more money to spend on the experiences I value.

There are upwards of 100 budget categories.

I also invest in passive income streams. As silly as it sounds, my budget has become like a best friend, or bestie, because I communicate with it regularly, and it knows everything about me and my finances!

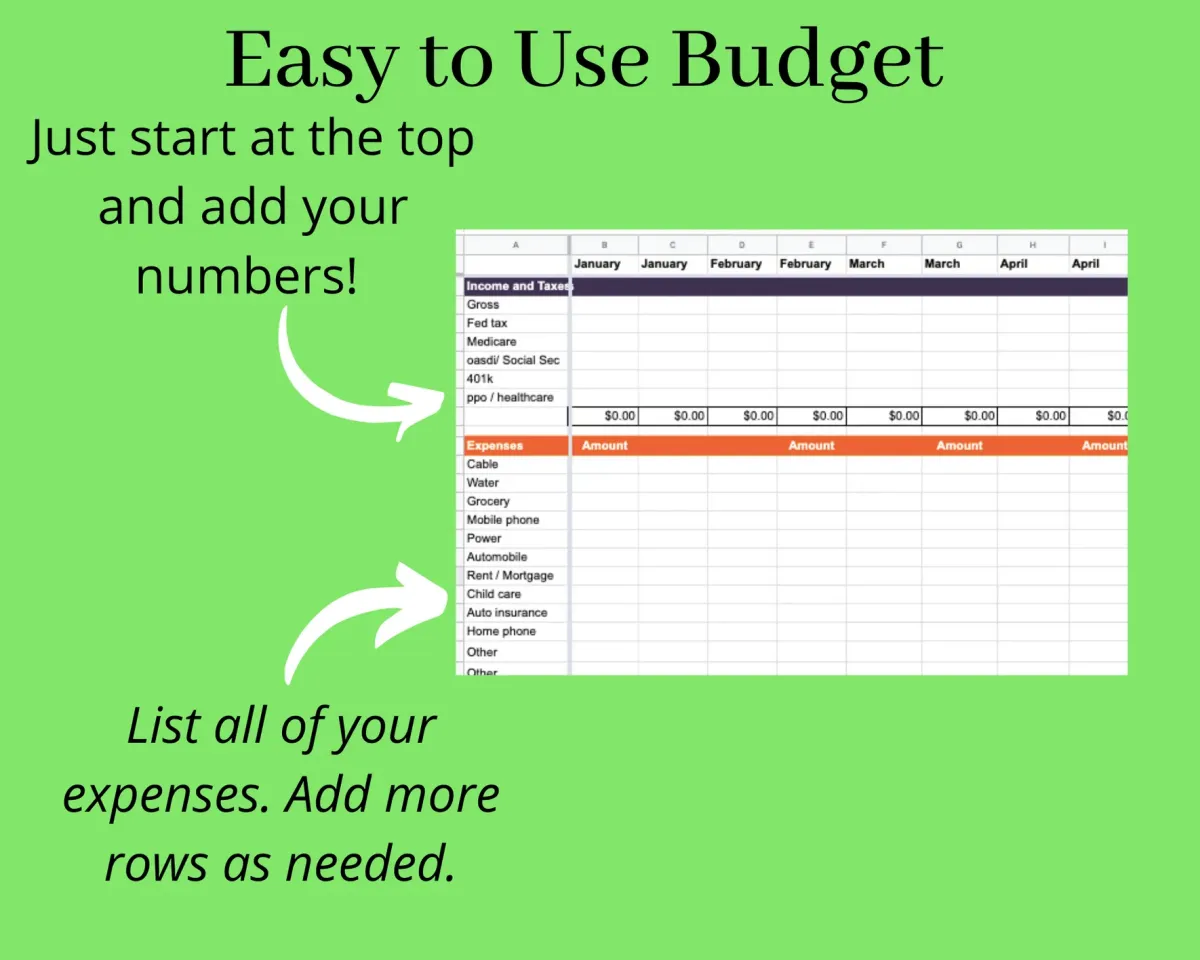

Tip: A good budget has totals for each category that are automatically summed for you. It’s also nice to see the entire year on one spreadsheet. If you are good at Excel, get the one I use here!

I review my budget category totals in my Budget Bestie spreadsheet at the end of the year. I focus on the categories with the highest totals first and assess if there is any way I can or would be willing to reduce the expense. As you can imagine, the highest expenses are usually:

Taxes

Taxes are typically deferred when investing in certain retirement accounts, like a 401k. Check out my course to learn more about how tax-deferred accounts work.

Housing

Housing is where some bravery comes into play. If you are uncomfortable with how much you are spending and not happy with how much you are saving, you may have to make some tough decisions. I know about this all too well. When I divorced in 2017 and looked at my end-of-the-year budget, I realized I had to sell my 3,000 square foot house and move someplace less expensive. Believe it or not, I felt a big relief when I moved into a tiny 2-bedroom home with rent that was $1,000 a month cheaper than my previous mortgage! You may not want to move, and in that case, brainstorm ways to lessen your housing expense or other expenses.

Transportation

This expense can range from subway tickets, Ubers, to monthly automobile payments and insurance. Shop around to get the best deals.

and

Food

Food is an area that literally eats up our budget. I constantly get asked, “

how can I save money on groceries?

There are a few ways that I save on my grocery bill. Here are my favorite tips.

1.) Try a low-cost food store

I Aldi has vegan, gluten-free, and organic food options for less.

2.)Make a list and set a budget before you go shopping.

I use a meal planner app. There are several grocery list and meal planning apps available for free. This keeps me on track while at the store, and I can quickly check off my list as I shop. Some people use cash envelopes or cash binders with their budget planner.

How to successfully close out your budget at the end month and end of the year

Each month I reconcile my checking about to make sure all checks and bills from last month are cleared. Then I use my spreadsheet or financial freedom workbook to document the expenses and spending for the new month. It's easier to explain if you want this video

Here is precisely how I close out my end-of-year budget.

I print out my checking account and credit card statements and look at each transaction. There are likely subscriptions and autopay items that you don’t use or need to check into. One year, I had a Netflix charge on my credit card each month of the year, but I hadn’t even subscribed to Netflix at the time!

What subscriptions can you eliminate?

I once again look at my Budget Bestie Financial Freedom Planner overall for the year. I take note of what items are due at certain times of year (e.g., my auto insurance is scheduled twice a year). I ensure that I am properly setting aside enough money in those months to cover the additional budget items. I also look at trends in my utility bills to ensure nothing seems out of order. If your water bill is slowly creeping each month, you could leak!

Finally, I examine my savings, retirement, and investment allocations. Then I ask myself a very important question, “am I saving enough?”. If you are unsure, check out Personal Capital’s free tools to get an idea of when you can retire and how much more you should invest to retire early.

Good luck with your budget! Subscribe to my channel on Youtube for more help with savings and investing for early retirement!

I am thankful you are here to learn and hope you find value here. I am not a financial advisor and this is not advice. I am sharing how I became financially independent in hopes that the information is useful to you in your research journey. Also, consult your tax accountant and do your own follow-up research. If you purchase on my Amazon Store links or other affiliate links, you are supporting me and this free information with no additional cost to you. Thank you!