12 Ways On How To Be Debt Free on a Low Income

Making a debt-free strategy can help you succeed, especially if you establish a deadline for achieving your objective. Taking proactive actions to address your financial difficulties is preferable to wallowing in distress and fretting about overdue debts. It all begins with a solid determination to repay your debts, regardless of the sorts of debt you have or how you got into debt. When getting out of debt is a top goal, there are several things you can do to pay off your debt completely — or at least the majority of it — in 12 months or less.

1) Get a Debt Consolidation loan

Debt consolidation is the practice of consolidating various debts into a single loan or balance transfer credit card with a lower interest rate.

Consolidating debt with a personal loan requires repaying each loan with the proceeds. While specific lenders specialize in debt consolidation loans, any personal loans can consolidate debt. Similarly, some lenders pay off debts on behalf of borrowers, while others disperse the funds to make their payments.

A debt consolidation loan allows you to pay off various obligations with a single monthly payment, such as credit card balances, student loans, medical costs, and utility bills.

2) Get a Second Job

A second job can help you pay off debt faster. Is it worthwhile to work a second job?

Having a second job can help you earn more money, especially if you keep your taxes in order, arrange your time correctly, and pick the right second job. If you choose a job that's in a completely different industry, you're less likely to upset your primary employer - and you'll also get the chance to develop new skills.

Working a second job can help you reach your financial goals faster in many cases.

Keep the following points in mind:

Will your current employer allow you to work a second job?

There could be some tax ramifications (it is your responsibility to inform the IRS of changes to your income)

Cities and urban areas have more part-time/flexible work opportunities, whereas rural areas have fewer. Nonetheless, there are numerous part-time jobs that you can do from home.

What are your family obligations? Could you work a second job around these obligations?

Working two jobs requires a lot of energy, advanced planning, and a positive attitude.

3) Cut back on expenses

Cutting back on expenses can help you pay off debt faster.

Begin keeping track of your spending habits - Printing out the statement to identify different spending categories is one approach to make things obvious. Write them down under the titles "needs" and "wants."

Make a Financial Plan - Determine how much you can put into an emergency fund and how much you can spend toward paying off credit card debt with that money.

Reconsider your subscriptions - ask yourself if you need the subscription.

Use Less Electricity - Electricity costs approximately 12% of the average household budget. Some immediate cost-cutting measures include: not leaving the computer on, not running the dishwasher without a full load, hanging out the laundry instead of using the dryer, and turning down the thermostat. Look around to see if utility providers offer lower rates, especially for fuel.

Reduce Your Housing Costs - If the cost of putting a roof over your head is prohibitively expensive, consider the following options:

If You Own a Home

Refinance. You may be able to reduce your monthly payments by switching to a different type of mortgage. Compare your options to see if refinancing can save you money.

Get a room to rent. Why not rent out your extra living space if you have one? Consider renting a room to a student if your house is near a college.

Relocate to a smaller space. If you don't need all of the room, downsize.

Move further from the city. Home prices in metropolitan areas are typically higher than in suburban and rural areas. Moving away from the action can result in significant savings.

If You Are Renting

Find a roommate. Having a roommate not only saves you money on rent, but you can also split the cost of your utility bills!

Move to a more affordable location. Rents can vary greatly depending on the rental property's age and location. Look around. The majority of neighborhoods have a plethora of rental options.

Negotiate. Rent is negotiable. If you've always paid on time and have been a good tenant, your landlord may be willing to lower your rent to keep you as a tenant. Call your landlord right away.

Consolidate your debts to save money on interest - Debt consolidation is the process of combining multiple debts into a single monthly payment. The ultimate goal is to reduce the amount of interest paid, lower the monthly payment, and pay off the debt.

Insurance Premiums Can Be Cut - Another way to cut monthly expenses is to change your home and auto insurance policies.

Cooking at Home or Eating at Home - Meal preparation and consumption at home can help you save a lot of money. Meal planning weekly can help. Figure out what you're going to eat for the week, plan it out, and then stick to it.

Make a List Before You Shop - It can be as straightforward or as complex as you want, and there are even apps that can help you make lists and find deals. Maintain a running list throughout the week, plan your meals, and add items to the list before you leave.

4) Stop using credit cards

Credit Impairs Self-Control

It most likely indicates that you do not have a budget.

It's Expensive to Pay Interest

Unpaid Balances Can Cause Rates to rise.

A low credit score has a significant impact

Financing increases spending

5) Avoid Payday Loans

A payday loan is a short-term loan that is typically granted for a small sum of money, has a high-interest rate, and must be repaid before your next payday - a short period.

If you're in financial trouble, don't beat yourself up; instead, take some time to assess your entire financial situation before making a move that could further complicate your finances. Fortunately, you have various options before agreeing to a financial tool that could potentially hurt your short- and long-term finances.

6) Pay More than the Minimum Payment

Pay more than the minimum payment. Setting priorities is critical when it comes to credit cards. First and foremost, always make your minimum payment on time. Then, go above and beyond the bare minimum. Ideally, you'll be able to eliminate the need to carry a credit card balance at all. This will help your credit score as well as your overall financial health.

7) Use your tax refund check to pay down debt

Paying off or reducing the balance on your credit card with your tax return can help you improve your credit utilization, boost your credit score, and become more financially stable in 2022 or the following year.

Unless you have other bills that are past due, statements that are in collections, or you do not have an emergency fund for other unexpected expenses, and your tax refund should be used to catch up on credit card debt.

8) Sell items for cash

Sell your unwanted stuff. I generally recommend selling your belongings away. The only exception is if you have any outstanding debts. You can sell it on Facebook Marketplace, Craiglist, Nextdoor and more. You can put that money towards your debt snowball.

9) Consider cashing in your life insurance

Excess premiums and earnings are used to fund reserves in cash-value life insurance products. These deposits are held in the cash-accumulation account of the policy.

Remember that while cash from the policy may be helpful during difficult financial times, you may face unfavorable consequences depending on how you access the funds.

Companies that purchase those policies typically do so for insureds in poor health. This gives the insured money to pay for medical treatment and other expenses. Hopefully, the company that buys it only has to spend a few premiums (hopefully) before receiving the death benefit.

Consider other options before using your life insurance policy for cash, such as borrowing against your 401(k) plan or taking out a home equity loan; none of these options are without drawbacks, but some are better than your current financial situation others.

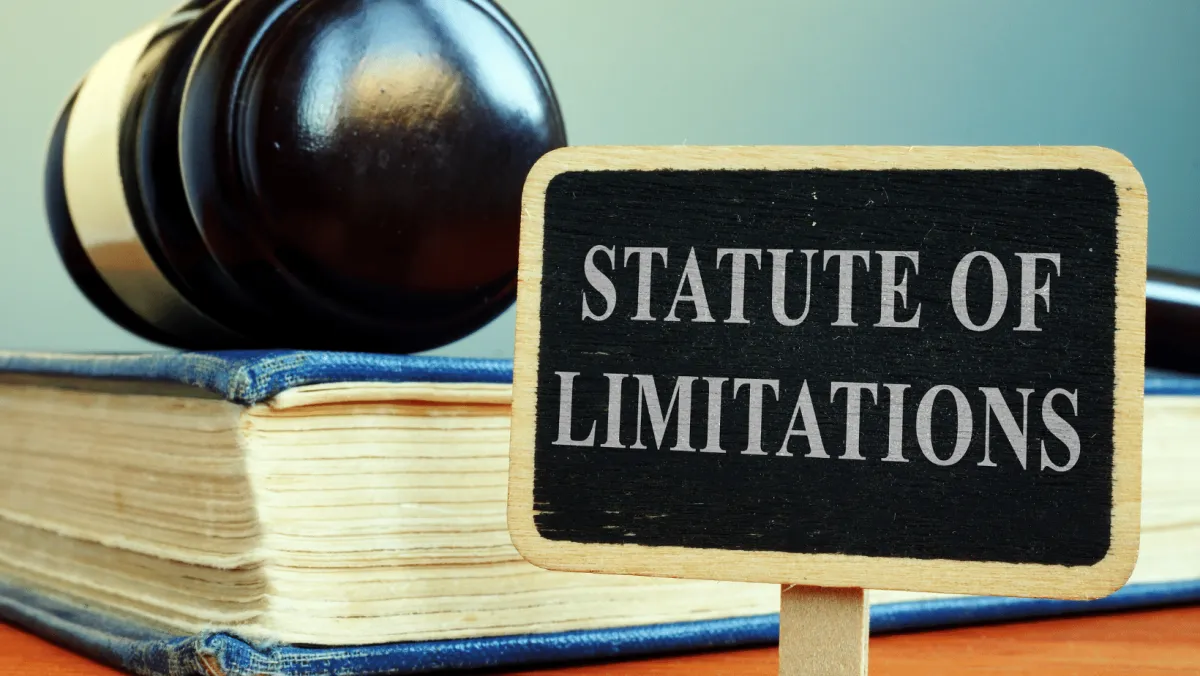

10) Use a statute of limitations law to eliminate old debt

The statute of limitations limits a creditor's ability to sue you for payment on a debt.

The amount of years creditors have the legal right to sue you for payment on all consumer debts, from credit card balances to hospital bills, is limited.

Time-barred debt occurs when a debt is older than the statute of limitations. That means creditors can't sue you for it, though debt collectors may still attempt. They can also pursue you through other means, such as phone calls and adverse credit reports.

You have a few alternatives if you do wish to pay:

Pay in full with a single payment.

Set up a payment plan with your creditor.

Make an arrangement to pay a portion of the amount to settle the debt.

Paying out the debt in full might help you get rid of it for good, but make sure you have everything in writing first. Keep this documentation if the payment isn't correctly recorded or the debt is sold to another collector.

The most crucial thing to remember is that such a case should not be dismissed. Ignoring it would very certainly result in an automatic judgment against you, which might result in pay garnishment. Pay attention to any alerts you get, respond swiftly, and stand up for your rights as a consumer.

11) File bankruptcy to discharge your credit card debts

Filing for bankruptcy might be an excellent treatment if you have significant debt troubles. Most collection efforts, including phone calls, income garnishments, and lawsuits, are halted (with some exceptions). It also eliminates various debts, such as credit card debt, medical expenses, personal loans, and more.

Bankruptcy permits those drowning in debt to discharge some debts and start over. The two most common kinds of bankruptcy, Chapter 7 and Chapter 13, each have different benefits and, in some situations, approach debt and property differently. Depending on your income, property, and ambitions, you'll select the appropriate chapter.

Regardless of whether you apply for Chapter 7 or Chapter 13, these are some things you should expect.

Here are several situations where filing for bankruptcy is a preferable option:

All other debt-relief alternatives have been tried or found inadequate, making bankruptcy a "last resort."

You're facing foreclosure, but Chapter 13 bankruptcy may be able to help you catch up on your payments.

Making debt payments would need taking money from your emergency or retirement accounts. In bankruptcy proceedings, retirement funds such as 401(k) accounts and Individual Retirement Accounts (IRAs) are safeguarded.

You can't make any debt payments without taking out payday loans, which have high-interest rates.

You've lost your work and cannot meet your debt settlement obligations. It will take more than one try to get out of debt.

12) Get help from a debt settlement company

Negotiating a debt settlement on your own is not easy, but it can save you time and money compared with hiring a debt settlement company. With a do-it-yourself debt settlement, you negotiate directly with your creditors to settle your debt for less than you originally owed.

Debt settlement companies operate with your creditors to settle your debt for a lower amount than you owe. This service may appear appealing, but it comes with substantial dangers, including the potential for credit harm, high costs, and no assurance that it will work. Debt settlement is often seen as a last resort option due to the risks. However, if this is your only alternative, you must engage with a respected firm.

There may be advantages to debt settlement, but you should also evaluate the disadvantages.

The advantages

Using a debt settlement business to settle a debt might.

Reduce the amount of debt you have.

Assist you in avoiding bankruptcy.

Get your creditors and debt collectors to stop bothering you.

The Disadvantages

Your creditors may refuse to negotiate.

You can wind up in much more debt.

Even if you don't pay off your entire loan, you may be charged fees.

It may have a negative influence on your credit.

Because of the risks, I don't suggest debt settlement as a first choice. However, if you're looking for debt settlement services, some may be better suited to your needs than others.

Conclusion

To ensure that you attain your ultimate objective of totally paying off your debts, you'll need to stay on top of things.

Things might seem a lot more manageable than they do right now if you have a strategy in place and get into the habit of thinking before you spend.