The rest of the story... Business Insider

On February 25, 2021 Business Insider published a story about me, Lakisha L. Simmons, and my journey to $750,000 in investments. As you can imagine, there were thousands and thousands of comments all over the Internet. I'm thankful to everyone who read the article and found some inspiration from it because it wasn't easy to disclose such personal information. Let me give you some back story...

I may have many accolades and degrees, but my life didn't start that way. I am the daughter of teen parents and grew up between Indianapolis, IN and Frankfort, KY. My mom dropped out of high school because her pregnancy was a tough one. At 18, my father went off to the United States Marines to make a better life for us. But ultimately life was just too tough for my mom and she sent me to live with various family members to care. Life was tough. But fortunately, one day in high school I was skipping class and saw a flyer on the wall that read "Historically Black College Tour". Luckily, I was able to attend that tour and the trajectory of life changed from that very moment on. Many ups and downs have happened since my childhood. Marriage, having children, divorce, and much more through workplace experiences. But I bring it up because I want you to know what is possible if you keep believing in yourself and keep pushing, no matter how hard it gets. Don't ever give up.

On January 1, 2021, I felt motivated to go into this year with the goal of helping as many people as possible to get ahead financially. In 2020 a tornado ripped through our town and Covid-19 devastated our families and revealed just how unprepared many of us are for an emergency. In addition, my current partner had been encouraging me to share what I had accomplished financially because "people need to know what is possible," he said. So I started blogging about my journey and you can read part 1 and part 2. Then, I wrote an Op-ed in our local paper because No One Is Coming To Save Us. Click to read the entire article.

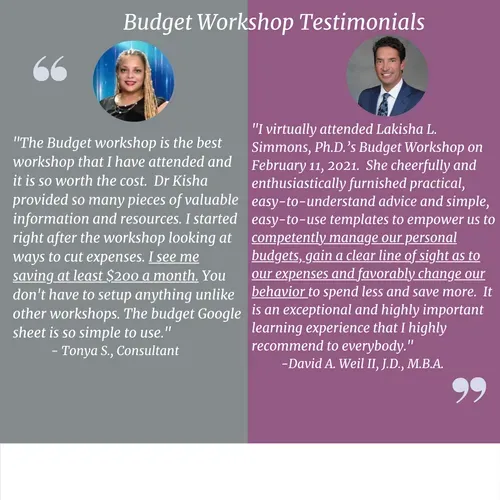

I wanted to further educate others on tips and techniques that can help them on their own financial journey. So in February, I created and hosted Budget Bestie, a live workshop with me where I walked participants through how I reduced my expenses down to less than $40,000 a year in hopes that they could use some of the tools.

I also give you access to my exact budget and how to manage your own expenses each month - something that is difficult for many people. I really just want to show you how you can easily substitute out services and products you already use for less expensive options.

For example, get cash back on your groceries for free! Fetch is a MUST! I shop at Aldi and Kroger and I use Fetch Rewards app to get cash back on groceries. You just scan your receipts after shopping and get points. Then you redeem your points for gift cards! Download the app and we both get credits!!! Click here for Fetch!

My biggest money saver was on my mobile phone bill. Contrary to popular belief, Mint Mobile doesn't know me and hasn't paid me to be a spokesperson. If you sign up, we'll both get a service credit. But if anyone knows Ryan Reynolds, I sure wouldn't mind being paid to do what I am already doing! I save over $1,000 a year on mobile service with Mint Mobile because I am on the 4 GB plan which is only $15 a month or $180 a year. You read that right!!! The best part is you can test it out for 30 days. Sign up and they will send you a sim card for your phone. It's very easy to do!

In mid-February I facilitated Marry Your 401k. Word was spreading fast and by the end of February, little old me was being interviewed by a writer at Business Insider. I honestly didn't think my story was that fascinating because, well, it's my life. But evidently there was power behind it that I couldn't see. The outpouring of men and women who have gone through divorce and similar upbringing are now inspired to focus their attention on their finances. That same weekend I facilitated how to calculate your financial independence number and basic stock trading the way I've always done it. I invited several women to attend at no cost.

The headline is a real attention grabber isn't it? So I'll fill in a few more details for those who want to know more.

1- The proceeds from the divorce. Unfortunately, I received less than $35k after closing cost from the sale of the house since we lived in it just under 2 years. Alimony? Nope. Child support? I don't give or receive it. I split the cost of my children's expenses - healthcare, childcare, etc.

2- I make slightly above middle class income including the women's empowerment workshops I've facilitated over the years and book sales. While that is a great salary, it's pretty devastating considering my accolades - bachelors, masters, PhD, tenured, and Six Sigma Black Belt. You would think I would make a lot more than that. But everyone is fully well aware of the pay gap for women and especially women of color. As Black women, we are over educated and underpaid. Can anyone relate?

3- I invest 60% of my income into the stock market maxing out my 403b and 457b. 4- The stock market has been good to me! Everyone knows the stock market makes millionaires and it doesn't discriminate. The amazing bull market has been wonderful for my accounts over the years. Past returns do not predict future returns by any means. The past is just that, the past. Plus, I buy during the dips (when the stock market is in the red). Consistency is key when it comes to investing and I share those in Trade Wages for Stocks. But look at these returns on money that was invested in the S&P 500 during the following time periods. Just amazing... 2017, 21%; 2018, -4%, 2019, 31%, 2020, 15%

I hope this clears up a lot of the comments and questions. In summary, I made a decent salary, but still not what I should for having (basically) four degrees. My average salary of $77,000 over my 19 years. But my salary, or sale of the house isn't the secret sauce. I know plenty of people who make as much as me or plenty more who are in tons of debt. It honestly comes down to deciding what you want to use your money for - financial independence or not. By not making a decision, you make the decision to work more years to afford your lifestyle. And that's okay, too!

Now, if you want to learn exactly what I did, I encourage you click the image below and get the course where I walk you through your path to financial independence! Thanks for reading!