My FIRE Story: How to maximize retirement savings to retire early

FIRE: How to maximize 401k retirement savings to retire early

Is maxing out your 401k enough to retire early? Here's how to max out your retirement savings. These tips will help you boost your retirement savings and retire early and today we’re diving into a topic that’s crucial for our financial empowerment: maximizing workplace retirement benefits. Whether you’re just starting your career journey or you’re a seasoned professional, understanding and optimizing your retirement savings can pave the way to true financial freedom.

Ladies, achieving financial freedom is within your reach, and maximizing your workplace retirement benefits is a significant step towards that goal. By understanding your options, contributing wisely, diversifying your investments, and leveraging tax benefits, you’re setting yourself up for a secure and prosperous future.

My FIRE Story

It’s official! I'm part of the great resignation! I’m done being an employee as of May 31, 2021, at the age of 41.

Turning in my resignation was one of the hardest things I’ve ever done. Even though I have financial security, not expecting a paycheck feels really strange! But I'm getting used to it!

Retirement is treating me very well. I'm relaxing, thinking, writing, meditating, and spending time with the ones I love! Soon, I'll have a couple of new blogs for you to learn more about retirement accounts: how I rolled over my 403B and what distribution election I plan to make for my 457b.

My journey to financial freedom was a very unlikely one, considering my childhood upbringing. I’m the daughter of teen parents and a first-generation college graduate. I achieved bachelor’s, master’s, and doctorate degrees. But guess what? I never learned about personal investing until my late 30s, when I taught myself about the stock market.

I wasn’t introduced to the concept of financial independence until I was 37 years old.

FIRE Mindset is Spending Less and Investing More.

Here are two things you need to do to get FIRE:

1. Build a Nest Egg to Live Off. When you save 25 times your living expenses, (click to read this called the “Trinity” study) you can live off that nest egg successfully for at least the next 30 years depending on your allocation. Specifically, 75 stock / 25 bond allocation. More often than not, you will die with more money in the nest egg than you started with even after withdrawing each year.

2. Live off 4% of your Nest Egg (give or tax percent or two) per the study quoted above. I’ll explain how to get that money out later.

After years of living what I thought was the American dream (family, degrees, job, house, car, etc.), and after my divorce in 2017, I found the strength to pursue financial freedom. I reconfigured my budget and doubled down on saving and investing. I had no excuses. I took complete control of my finances.

Financial independence, retire early (FIRE) is the concept of changing your spending and investing habits in life to focus on investing so you can become financially free.

When you can pay your living expenses from gains and passive income, you are financially free.

I saved and invested in the stock market until my nest egg reached 25 times my necessary annual expenses. I now can withdraw 4% annually to live off and spend my days as I wish. To determine how much I needed to invest each month, I referred to my savings rate.

The savings rate is the percent of your income that you save and invest. The more you save and invest, the faster you’ll build your nest egg due to the compounding effect of investing. The time to reach financial independence is heavily dependent on your savings rate. Your savings rate is the percentage of your gross income you save and invest each year.

Depending on your savings rate and how much risk you are willing to take, you will reach your number faster or slower. It’s not hard, it just takes time. How much time? Remember, it depends on how much you invest each year. The important thing is to start today.

If you are spending 100% of your income, you won’t have any money saved for retirement. As soon as you start saving and investing, you can potentially start seeing your money earn its own money, that you can eventually live off in retirement. Let’s say you are starting at zero dollars in investments and will start investing with earnings around 6% a year. You can use the Personal Capital retirement planner to do the math for you to determine when you can retire comfortably.

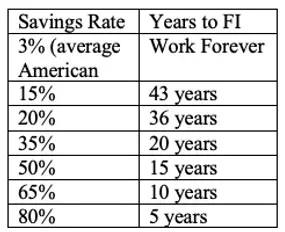

When I started investing, a savings rate of 15% would have retired me in about 43 years, 35% savings a year would have retired me in about 20 years, and 60% in about 10 years. That’s at a 6% average growth rate. During my accumulation years, the United States was experiencing a bull market with annual returns much higher than 6%, so I retired in much less time than I had estimated.

Now I monitor my investments with Personal Capital’s free online financial tools. With the Dashboard, I can see all of my financial accounts in one place. The planning tools allow me to analyze my investments and find hidden fees, and also prepare for spending in retirement.

How do I Build That Nest Egg?

Focus on your savings percentage rate. The more you save the faster you’ll build your nest egg. In 2012, Mr. Money Mustache revealed the shockingly simple math behind early retirement. The time to reach financial independence is purely dependent on your savings rate. Your savings rate is the percentage of your GROSS income you save and invest each year.

We’ve been told to save 10% of your income. If you do that you will need to save for 40+ years to live off your nest egg. How much are you currently saving? If you don’t know, you need to grab my FIRE Excel Workbook and start calculating your expenses and savings rate. The workbook comes with an explainer video of me walking you through all of the information.

Accumulate a nest egg of stocks (about 70% of portfolio) and bonds (about 30% of portfolio) where you can live off the appreciation (4%) of that nest egg amount each year. Depending on your savings rate and how much risk you are willing to take, you will reach your number faster or slower. It’s not hard, it just takes time. How much time? Remember, it depends on how much you invest each year.

Let’s say you are starting at 0 net worth and will start investing with earnings around 6% a year. According to Business Insider and many other writers on FIRE here’s how long it will roughly take you to build your nest egg to retire:

Five, ten, and 15 years go by really fast. If you are 30 you can easily be financially free by 45 years old if you live on half your income. It has been done. But do you see how increasing a percent leads to earlier retirement? You can start at any age but the first few years are the hardest and longest, the first 100k takes the longest but then you will be working with exponential growth.

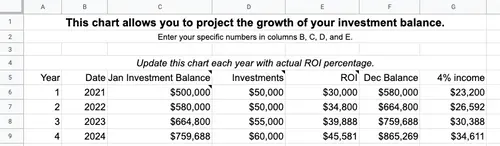

Put another way, you can estimate your contributions and investment growth in a spreadsheet like this one in the FIRE workbook. The calculations have already been entered for you. Get it today.

But it’s impossible to save half my income, right?

You won’t get there overnight. Start by doubling what you currently contribute. You just have to think about what you value. Do you value expensive bags, shoes, and clothes over saving half your income so you can be wealthy? How much do you value things that won’t pay you 6% annual dividends? I am not trying to throw shade. I’m just trying to get you to think about these things long-term. Today, you might enjoy your “job”. But within 5 years you may hate it and need a break. But if you can’t produce income from investments or real estate or something, you will have to go to work. There are things you can do to start to reduce your expenses and invest more. For example, I switched from Verizon to Mint Mobile. My iPhone X is paid off and I wasn’t on any contract. Mint Mobile is a flat $15 a month (3GB Plan, I average about 2GB) and it runs on the T-Mobile network. I have noticed no difference in service from Verizon. I love it! You can try it out before cutting off your current service. That’s what I did. Check it out.

How much of a nest egg do I specifically need to be Financially Independent?

It’s this simple: Take the living expenses that you plan to have when you stop working and multiply the amount by 25. Living expenses are housing, healthcare, childcare, food, bills, travel, and reasonable spending, etc. Don't struggle with the math. I've created the calculations for you in the FIRE workbook. This automated spreadsheet is one of several in a workbook to help you plan out your FIRE plans. Get it on my Esty shop!

This calculator is in my FIRE Workbook. Check it out.

Side note: Social security is such a small factor that I don’t usually include it in my calculations. If anything, I look at it like getting a Christmas bonus.

How do I allocate the contributions and what do I invest in?

I start with my workplace retirement accounts because of the tax savings. Personally, I buy growth mutual funds and bonds with low expense ratios. Bonds should be held in retirement accounts versus brokerage accounts because pretax retirement accounts shelter taxes. Meaning, the dividends from bonds will not create a taxable event for you this year as they would if you held bonds in your brokerage. I max out my pre-tax retirement accounts each month first because this lowers my taxes right now.

Entrepreneurs! You have not been forgotten! You have a sweet deal if you are an LLC or Limited Partnership. You can contribute to a Self-Employed 401k or a Solo 401k and contribute up to $56,000 per year. This money is protected from taxes!

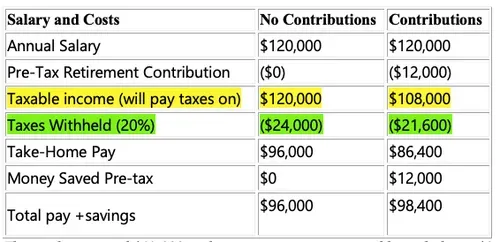

Here is an example of the paycheck tax savings:

The employee saved $12,000 in their retirement account and brought home $2,400 more than if he or she didn’t save at all. Boom! I use TaxCaster (free) by Turbo Tax to estimate my refund.

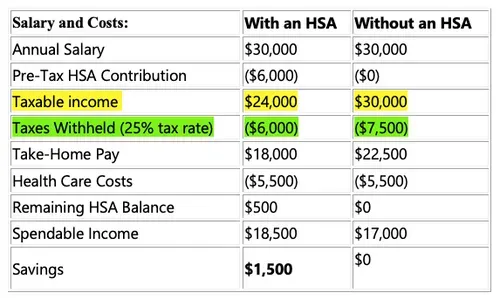

1. HSA accounts: If it’s right for your situation and you choose a high deductible healthcare plan, you will have a healthcare savings account (HSA) tied to it.

a. The HSA is a wonderful way to save more money pretax! If you end up having healthcare expenses you simply pay from them out of your HSA. Look at the chart below and notice the tax savings:

b. Here is an even better benefit that often isn’t spoken about. You can delay taxing an HSA distribution for medical expenses. The great benefit of having an HSA is that I can decide when to pay myself back. Since there is no rule stating that you must use your HSA to directly pay for medical expenses or that you must withdraw money from your HSA within a certain amount of time after paying for a medical expense, you can take out the money when you want. As long as the qualified medical expense occurred after the HSA was opened, you can withdraw money from the HSA at any time after incurring the expense to reimburse yourself. Since I am already maxing out my other tax-advantaged accounts and have ample savings, a $250 doctor bill payment isn’t going to break the bank so there is no rush to get paid back from my HSA. Instead, I can leave that $250 in my HSA and can sit back and watch it grow, tax-free, until I decide to withdraw it.

I need to keep my receipts (and make digital copies, in case the physical copies wear out) so I can withdraw the money for qualified medical expenses from my HSA at any time. If you don’t use your HSA funds for medical expenses, you can begin withdrawing money from your HSA account for any expenses after you turn 65, without penalty. You’ll have to pay income tax on any distributions that aren’t for qualified medical expenses, just like you would with a Traditional IRA, but you won’t incur any additional penalties or fees. Therefore, after the age of 65, an HSA is nearly identical to a Traditional IRA but it’s still better because your withdrawals for medical expenses are still completely tax-free!

2. Next, I max out my Roth IRA. This is funded with after-tax money. Once you receive your paycheck you can send money to a Roth IRA. You will not save any income taxes at the time of the contribution. You can always take out your contributions tax and penalty-free any time. There is also such thing as a Roth 401(k) at some workplaces. You may or may not be able to contribute to this if you are maxing out your pre-tax retirement account. Get your own professional advice.

3. Lastly, I put funds into my brokerage account at Vanguard. I purchase stock market index funds. Index funds are comprised of many stocks. I try to stay away from individual stocks because it’s difficult to stay diversified. It’s riskier to me to hold individual companies versus a fund of many companies. You may be fine with the risk and that is okay. You should always do what’s best for your situation. For me and my house, we focus on the S&P 500 index mutual fund called VTSAX (about $95 a share at the time I wrote this) or index ETF called VOO (about $195 a share at the time I wrote this). Learn more about it at Vanguard. This is what I do and I am not saying it is what you should do because you are reading this. Contact me with questions.

4. Entrepreneurs can start retirement plans as discussed in Part 1 of this series. They can also jump straight into a brokerage account and start investing in index funds.

Whew, that was a lot!

Is It Possible for You?

I know this may sound scary if you’ve never invested before. You may be thinking, “I can’t afford to lose any money” or “I don’t know where to start.” With education and positive money affirmations, you can reach your goals! You just have to get started.

Is it even possible to become financially free? Is it possible to have all your expenses covered from capital gains (real estate, business, stock, bond, or equity investments)?

It’s possible if you live on less than you make and invest the rest. Not everyone is able to do this, but many of us who make average salaries or more can do it.

First: Why Workplace Retirement Benefits Matter

Let’s start with the basics. Your workplace retirement benefits, such as 401(k) plans or employer-matched contributions, are not just perks—they’re powerful tools that can grow your wealth over time. These benefits often include tax advantages and employer contributions, making them a cornerstone of smart financial planning.

The first question is, would you like to be healthier, wealthier, and happier? If so, you have to work towards that. This world, from pandemics to tornadoes to all the things we see in the media, is full of challenges. You have to make a decision in life to be happy and healthy, and it takes intentional work to work out and eat right. The same goes for your budget and your money—it takes intention.

There are three steps that led me on my path to financial freedom. The first one is budgeting. We always hear about budgeting and think we know how to budget, but you need an effective system in place. One tool is a Google Sheet that is automated with formulas. I use it to input my amounts for the entire year, so I know what to expect each month. For instance, if I know I'll want to do some shopping in November, I'll budget more for that month. It’s important to see your finances at a glance for the entire year and forecast your spending and savings.

The second part of budgeting is using an app or tracker for when you spend money or when money comes out of your account. For example, I use my budget bestie and The Wealthy AchieveHer planner. This helps you stay on top of your spending and manage your finances effectively.

Here are two ways you can reduce your expenses by 10%. In my Budgeting Bestie course, I provide many more strategies, but let’s go over two of them. First, use a 10-day spending tracker. This will help you understand exactly how much you're spending. By writing everything down, you can clearly see where you might be overspending and adjust accordingly. Second, cut the cable. If you still have cable, it's unnecessary. I cut my cable bill in 2017 and saved $1,100 a year. You can still watch the news and basic TV with an antenna and use streaming services for other content.

Now let's talk about step two: marrying your 401(k). It’s important to know everything about tax-deferred savings. In the full financial freedom course, I detail the various types of tax-deferred and after-tax accounts, such as brokerage accounts. For instance, contributing to a 401(k) can reduce your taxable income, which saves you money on taxes. By contributing to tax-deferred accounts, you can accumulate savings while reducing your tax burden.

Marry Your 401(k)

It's important to know everything about tax-deferred savings. In the Financial Freedom course, I go into details about various tax-deferred and after-tax accounts. Here's an example:

Imagine an annual salary of $120,000. If you contribute $12,000 to your 401(k), your taxable income reduces from $120,000 to $108,000. This means you pay less in taxes, increasing your take-home pay. The IRS allows you to invest up to $19,500 in a 401(k) annually. This tax advantage can help you save more and invest in the stock market.

457 Plans

If you are a police officer, fireman, nurse, doctor, or teacher, you might be eligible for a 457 plan. This is another tax-deferred option allowing you to save an additional $19,500 annually, potentially letting you save up to $40,000 a year tax-deferred. This significant tax saving can contribute greatly to your wealth-building strategy.

Roth IRA

A Roth IRA allows you to contribute up to $6,000 annually (subject to income limits). Contributions are made with after-tax dollars, but the growth and withdrawals are tax-free, which can be advantageous in your long-term financial planning.

By strategically using these accounts, you can maximize your savings and minimize your tax burden, significantly contributing to your journey towards financial freedom.

Did you learn something new? I hope you did! If you're ready to join me on the journey to financial freedom, please sign up for the workshop. If you're not ready yet, no pressure—there are plenty of free tutorials, worksheets, and blogs on my website to help you get started.

Remember, it’s never too early or too late to start planning for retirement. Take charge of your financial destiny today, and watch your wealth grow tomorrow. Here’s to building a future where financial freedom is not just a dream but a reality we all enjoy.

Stay fabulous and financially empowered!

Stay Happy, Healthy and Wealthy,

Warm regards,

Dr. Lakisha L. Simmons

Lakisha L. Simmons, Ph.D. left her full time position as a tenured professor of analytics financially independent at 41 years old. She is the author of The Unlikely Achieveher and CEO of BRAVE Consulting where she facilitates The Wealthy AchieveHer Mastermind to help women how to make, save and invest more money to early retire. She enjoys traveling, exercising, and spending quality time with her family. She can be reached via LakishaSimmons.com or on social media at @drkishasimmons