Debt Management After Divorce: 9 Steps to Rebuild Your Finances

Debt Management After Divorce: 9 Steps to Rebuild Your Finances

Want to Rebuilding Your Finances After Divorce? I want to share some essential tips on rebuilding your finances after a divorce. I've been there and you will get through this. Navigating the financial aftermath of a divorce can be challenging, but with the right strategies, you can regain control and build a stable financial future.

I want to talk about divorce. No, we don't like it—it's very tough. You know, I heard a saying that goes, "Pick your hard. Divorce is hard; marriage is hard. Pick your hard." That is so very true. But when you've made the decision to divorce, there's something very important you need to think about: What are you going to do when he moves out? Today, in this video, I'm going to give you five tips to prepare yourself for if and when that time comes—when your husband or long-term partner moves out. What can you expect? Let's get into it.

First, prepare yourself. I know that may sound silly, but if you sometimes wonder during arguments or disagreements, or if you have suspicions or have talked about getting a divorce, the time to prepare is now. Don't wait any longer. Divorce is tough, and I’ve made other videos about this, but today I want to go specifically into five tips for you.

Step 1: Assess Your Financial Situation

The first step is to get a clear picture of your financial situation. List all your sources of income and expenses, including any debts. Understanding your financial landscape will help you make informed decisions and prioritize your spending.

Step 2: If you have a home, get a home warranty.

When something goes wrong in the house, you won’t have him to help fix it. Going through the emotional struggle of a divorce is hard enough without dealing with a broken water heater or HVAC system. For example, I bought a new home this summer, and since the home was older, I knew eventually something would go wrong. I had the seller pay for a home warranty, which cost about $700. Thank God I had it because when the HVAC went out, they gave me $2500 to help pay for it. It’s a great trade-off.

Also, consider downsizing to a smaller home or apartment that better suits your needs. Renting can be a more affordable option initially, allowing you to save money and rebuild your financial foundation.

Be mindful of your energy usage to lower your utility bills. Simple changes like turning off lights when not in use, using energy-efficient appliances, and adjusting your thermostat can make a big difference.

Step 3: You’ve got to get that budget together, sis.

Develop a budget that aligns with your new financial reality. Develop a budget that aligns with your new financial reality. Track your expenses diligently and identify areas where you can cut back.

Track your expenses diligently and identify areas where you can cut back. Budgeting is crucial for managing your finances and ensuring you stay on track. I’m sorry, but you need to sit down, pull all your credit cards, bank accounts, and bills. If you need help, drop a comment below, and I’ll send you the budget I use. I

The budget will help you see where you stand financially and if you’ll need supplemental income. Be prepared to pay all household expenses on your own. You need to be aware of your financial situation and what you’re responsible for if he stops contributing.

Click below to get your paperback of The Wealthy AchieveHer Budget Book!

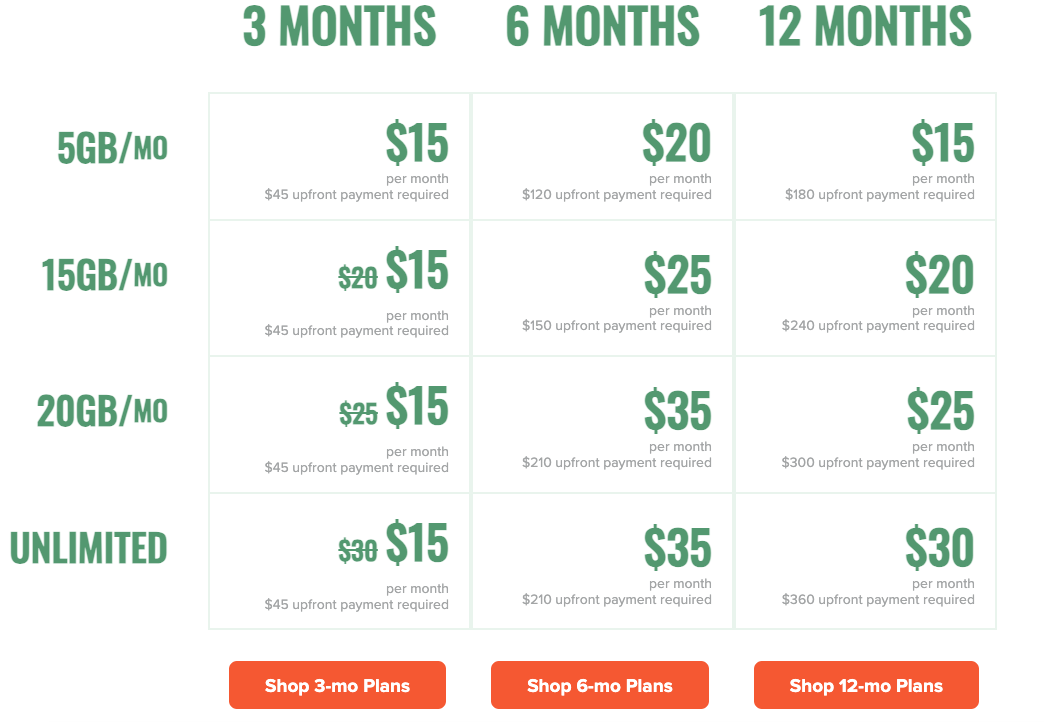

Step 4: Switch to a more cost-effective mobile plan.

I use Mint Mobile, which has served me well. It’s a prepaid service; I pay about $300–$325 for 12 months, including unlimited talk, text, and data. Click below for a link to Mint Mobile (affiliate at no cost to you).

Step 5: Prioritize Your Debts

Focus on covering essential expenses first, such as housing, utilities, groceries, and childcare. After that, allocate funds for other necessary expenses like transportation and insurance. Prioritizing your spending will help you manage your finances more effectively.

Focus on paying off high-interest debts first, as they cost you the most over time. Here are two effective strategies:

Avalanche Method: Pay off debts with the highest interest rates first while making minimum payments on others.

Snowball Method: Pay off the smallest debts first to build momentum and motivation.

Choose the method that works best for you and stick to it. Watch my YouTube on this topic

Step 6: Build an emergency fund.

An emergency fund is essential for financial security. Aim to save three to six months’ worth of living expenses. This fund will provide a safety net in case of unexpected expenses or income loss. Aim for at least three months of expenses in the fund. Start putting money aside now, especially if things are rocky. Some people say to keep all money in a joint account, but if you know things are headed for divorce, you need to prepare yourself. When he moves out, you might be on your own financially.

Take a close look at your subscriptions and memberships. Cancel any that are not essential or that you can live without. This can free up extra money that can be redirected towards savings or debt repayment.

Step 7: Start a side hustle.

If your budget isn’t enough, consider ways to earn extra income. Some options include affiliate programs, writing a blog, publishing a book, or doing delivery services like DoorDash or Amazon deliveries. These can help supplement your income.

For a full strategy on side income to rebuild, read this blog post: How I Generated $5,000 in Side Income Monthly and retired early (helpful for for single moms)

Look for ways to boost your income during this period. Consider:

Freelancing: Offer your skills on platforms like Upwork or Fiverr.

Part-Time Work: Take on a part-time job or gig work.

Selling Unused Items: Sell items you no longer need on platforms like eBay or Facebook Marketplace.

Use the extra income to make larger debt payments.

Going through a divorce is a daunting and emotional process. Counseling for you and your children is highly recommended and should be part of your budget. Surround yourself with a strong support system. Watch my other video about friends and friendships during this time. Remember, this too shall pass. It may get worse before it gets better, but it will get better.

I hope these tips have helped you if you are thinking about divorce or are in the midst of separation or divorcing. Let's do this together. Reach out to me, leave a comment below, and share this video with a friend who might be going through a divorce.

Step 8: Rebuild Your Credit

Rebuilding your credit is crucial for your financial future. Make sure to pay your bills on time, keep your credit card balances low, and avoid taking on new debt. Over time, these actions will improve your credit score.

Don’t hesitate to reach out to your creditors and negotiate better terms. You might be able to lower your interest rates or set up a more manageable payment plan. This can significantly reduce the amount you owe and help you save money.

Step 9: Seek Professional Advice

Revisit your insurance policies, such as health, life, and auto insurance. Make sure they accurately reflect your post-divorce circumstances.

Consider working with an accountant, coach (contact me at https://www.theachieveher.com/coaching) or a financial advisor who can provide personalized advice based on your unique situation. They can help you create a comprehensive financial plan and guide you through the complexities of managing your finances post-divorce.

My Personal Journey

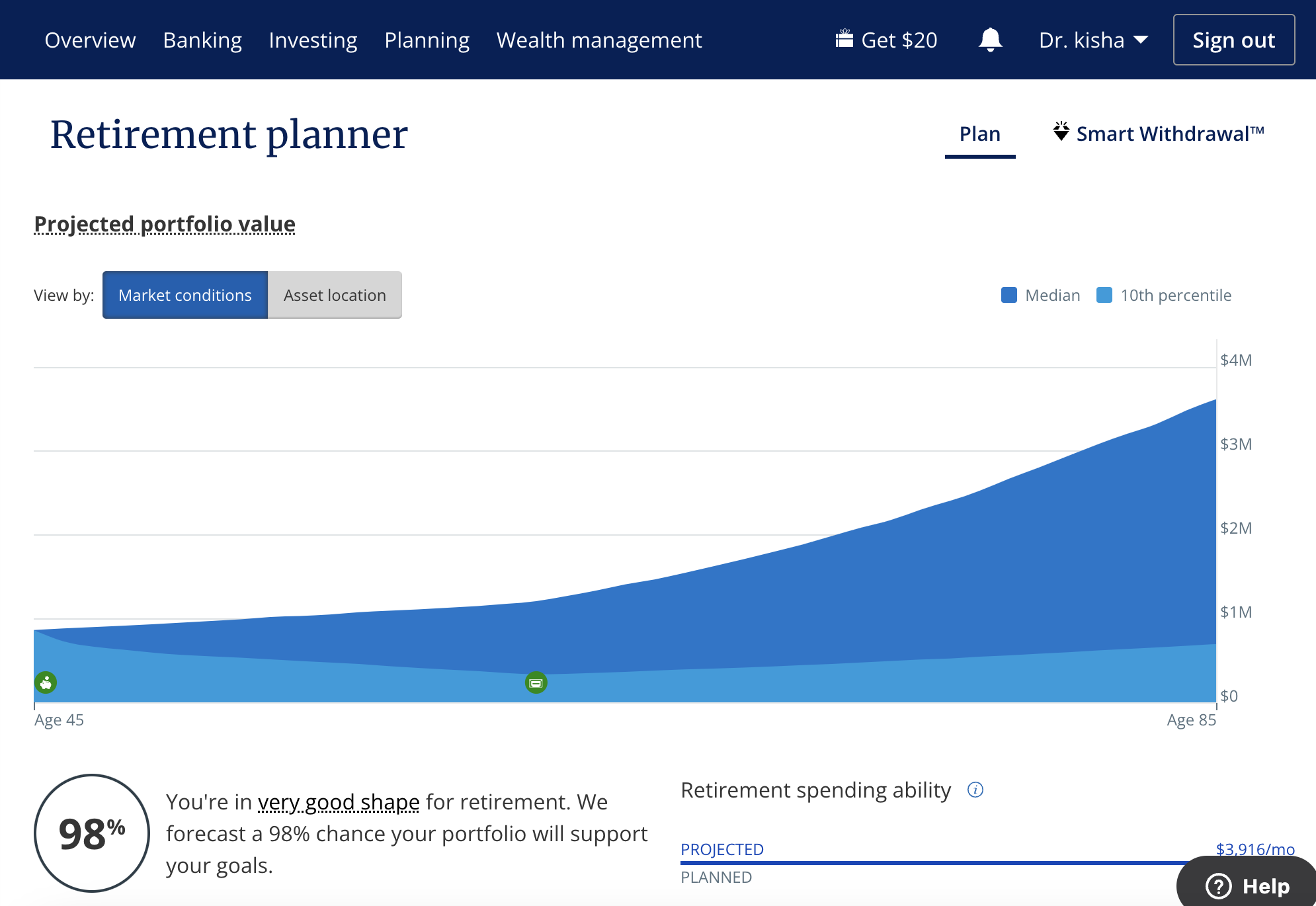

As a single mom, I understand the financial challenges that come with divorce. By following these steps, I was able to regain control of my finances and build a stable future for myself and my children. It wasn’t always easy, but with determination and smart financial decisions, I achieved financial stability. You can do it too!

Final Thoughts

Rebuilding your finances after a divorce is crucial for creating a stable and prosperous future. By assessing your financial situation, creating a realistic budget, and making informed decisions, you can achieve financial stability and success. Remember, every small step you take brings you closer to financial freedom. Start today, and watch your financial situation transform!

Saving money effectively after a divorce is crucial for rebuilding your financial foundation. By assessing your financial situation, creating a realistic budget, and making smart financial decisions, you can achieve financial stability and success. Remember, every small step you take brings you closer to financial freedom.

Join our community of Achievers at LakishaSimmons.com, sign up for the Financial Freedom kit, and let’s work together. You can do it!

Stay Happy, Healthy and Wealthy,

Warm regards,

Dr. Lakisha L. Simmons

Lakisha L. Simmons, Ph.D. left her full time position as a tenured professor of analytics financially independent at 41 years old. She is the author of The Unlikely Achieveher and CEO of BRAVE Consulting where she facilitates The Wealthy AchieveHer Mastermind to help women how to make, save and invest more money to early retire. She enjoys traveling, exercising, and spending quality time with her family. She can be reached via LakishaSimmons.com or on social media at @drkishasimmons